ESG Policy

Through investments into seed and early-stage companies, VIVES Funds have

- supported companies stemming from academic research and having positive impact;

- supported the employment and economic growth;

- provided their portfolio companies with a chance to grow and expand their businesses, developing further their high technology products and innovations.

VIVES Funds have the ambition to act responsibly through their investments and are convinced that the inclusion of extra-financial criteria in their investment activities is essential to support long-term growth.

VIVES Funds take investment and management decisions that do not only aim for a higher corporate return, but combine this with taking the opportunities to improve the environment, the well-being of employees and the society, going beyond what is legally required, based on a vision of social involvement and sustainability.

VIVES Funds challenge and support the management teams of their portfolio companies with the objective to increase their ESG commitments.

VIVES Funds have established the following principles:

- Along with the financial indicators, risk assessment and investment opportunity evaluation, VIVES Funds assess the ESG aspects of each case, which mean

- we take into consideration the potential environmental impacts of the companies and/or of their products & services, their social responsibility and their corporate governance;

- responsibility in investment activities is an integrated part of VIVES Funds investment and ownership process.

- In the selection of the portfolio companies, VIVES Funds aim to select only companies with sustainable development, sound business practices, and if possible, environmentally positive overall impact factors.

Kind of questions that may be asked during this selection process: to what extent a company contributes towards the resolution of a material ESG challenge in its industry? To what extent is the company solution unique, innovative, and able to scale up quickly and profitably while achieving a positive societal impact by addressing the ESG issues? How sustainable is the opportunity given current ESG trends and how easy is it for the solution to be imitated by others?

- After a professional and sound selection phase, VIVES Funds work actively with their portfolio companies, in order to secure sound business practices and operations, in compliance with good corporate governance principles.

- At EXIT phase, VIVES Fund aim to carefully evaluate the buyer profile, transaction model and fair treatment of various shareholders (employees, option holders, etc.). Our ambition is to select EXITs that continue to contribute to the local and regional ecosystem in the long run.

- VIVES Funds conduct surveys to gather ESG relevant information from its portfolio companies.

- As examples, the following criteria may be relevant throughout our relationships with portfolio companies:

Environmental - company’s energy use, waste, pollution, natural resource conservation, and treatment of animals, environmental risks management.

Social - values of the company and e.g. its suppliers, company’s working conditions, health, safety or gender policy, management of company stakeholders’ interests.

Governance - appropriate (accurate and transparent) accounting methods, management of conflicts of interest, governance bodies composition and functioning.

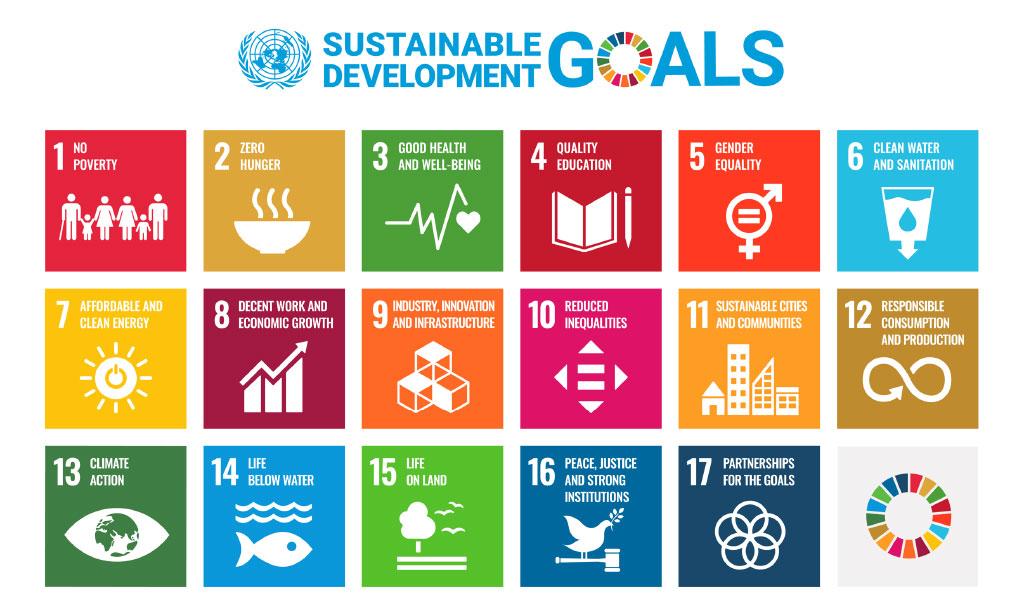

N.B. A point of reference consists in the 17 UN SDGs (Sustainable Development Goals):

In addition, VIVES Funds follow the UN Principles for Responsible Investment and promote acceptance and implementation of the PRI within the investment industry.